Transforming Risk Management: How AI Is Redefining Business Resilience

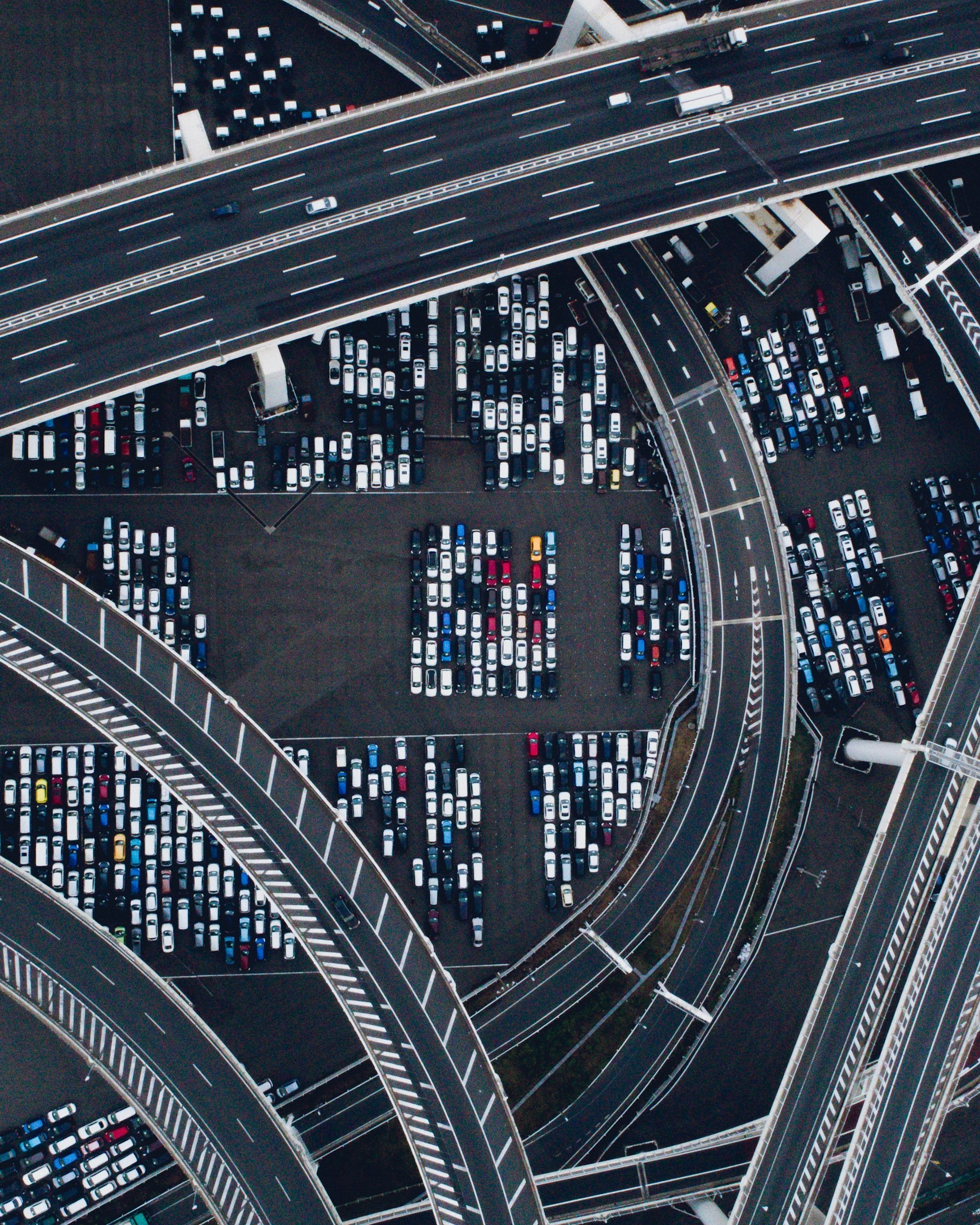

Photo by Chris Turgeon on Unsplash

Introduction: The New Era of Risk Management

Business risk management has always been about anticipating threats, preventing losses, and ensuring operational continuity. In today’s digital landscape,

artificial intelligence (AI)

is fundamentally transforming how organizations approach risk. Instead of relying on slow, reactive methods, companies now leverage AI for real-time prediction, rapid response, and comprehensive risk mitigation strategies

[1]

. This shift is especially crucial as financial fraud, cyberattacks, and regulatory pressures escalate in complexity and frequency.

How AI Enhances Risk Detection and Prevention

Traditional risk management frameworks depend on historical data and manual analysis, which often lag behind fast-moving business threats. AI changes this paradigm by:

-

Real-Time Threat Detection:

AI algorithms analyze vast amounts of transactional and behavioral data, spotting anomalies and suspicious patterns that signal potential fraud or breaches. For example, leading banks employ machine learning systems trained on payment histories to instantly flag and block fraudulent transactions [2] . -

Predictive Risk Modeling:

AI-powered models forecast the likelihood of events such as loan defaults or operational failures with far greater accuracy than traditional regression techniques. By capturing nonlinear relationships between economic variables and organizational factors, AI enables superior forecasting-even under stressed scenarios [3] . -

Automated Compliance and Reporting:

Regulatory compliance often involves tedious, error-prone processes. AI automates assessments and reporting, ensuring timely and accurate adherence to evolving regulations. Machine learning tools monitor employee communications, trading activities, and system access to identify non-compliant behavior before it escalates [2] .

Building a Proactive Risk Management Strategy with AI

To harness AI’s benefits, organizations must develop a robust risk management strategy that integrates technology, people, and processes:

Step 1: Assemble a Cross-Functional Task Force

Effective AI risk management requires collaboration across IT, legal, compliance, and insurance teams. Establish a dedicated task force to oversee technology implementation, regulatory changes, and crisis response planning. This group should regularly review system performance, address emerging risks, and ensure alignment with business objectives [5] .

Step 2: Implement AI-Driven Risk Assessment Tools

Deploy machine learning solutions capable of analyzing large volumes of structured and unstructured data. These tools should handle:

Photo by Alejandro Barba on Unsplash

- Fraud detection and prevention

- Credit risk analysis

- Operational risk monitoring

- Regulatory compliance tracking

When selecting technology vendors, prioritize platforms with proven security features, transparent algorithms, and support for ongoing model validation [3] .

Step 3: Establish Continuous Education and Training

AI-related risks and regulations evolve rapidly. Maintain a regular training schedule for staff at all levels, covering:

- AI technology fundamentals

- Data privacy and security protocols

- Regulatory updates

- Incident response procedures

Partnering with experienced insurance brokers who have access to global networks can further help organizations stay ahead of new market requirements and industry-specific challenges [5] .

Practical Applications and Industry Examples

AI’s impact on risk management spans multiple sectors. Here are some real-world applications:

Banking and Finance:

Financial institutions use AI/ML systems to detect credit card fraud, monitor traders’ activities, and analyze customer data for accurate credit decisions. These solutions reduce operational costs and lower losses due to fraud

[2]

[3]

.

Enterprise Operations:

AI automates risk assessments and compliance monitoring for multinational organizations, enabling them to anticipate regulatory changes and prevent costly missteps

[1]

.

Insurance:

Insurers leverage AI to analyze claims, predict fraud, and optimize policy pricing, helping businesses secure comprehensive coverage and minimize exposure

[5]

.

Challenges and Solutions in AI Risk Management

Despite its promise, AI introduces new risks that must be managed:

AI System Bias and Transparency

AI models trained on biased or incomplete data can produce unfair or inaccurate results. To address this, organizations should:

- Follow ISO/IEC standards for transparency and accountability in AI risk management [4] .

- Conduct regular audits and model validations

- Document decision processes and ensure explainability

Cybersecurity Threats

AI systems are attractive targets for cybercriminals. Strengthen security by:

- Implementing robust access controls

- Encrypting sensitive data

- Monitoring for unusual system activity

- Regularly updating security protocols

Regulatory Compliance

AI regulations vary by region and industry. Companies must proactively track regulatory changes and adapt their policies. Seek guidance from legal experts and relevant agencies for the latest requirements. When in doubt, visit official government or industry regulator websites and search for “AI risk management standards” or “AI compliance guidelines” for authoritative information.

Step-by-Step Guidance for Implementing AI Risk Management

Organizations seeking to maximize the benefits and minimize the risks of AI should follow these steps:

- Define risk management objectives and prioritize business-critical threats.

- Assess current data infrastructure and identify gaps in data quality, accessibility, and security.

- Select AI tools with strong validation protocols and transparent decision-making processes.

- Build a cross-functional team to oversee implementation, ongoing monitoring, and incident response.

- Regularly review and update risk management policies to reflect changes in technology and regulation.

- Invest in ongoing education for all stakeholders to keep pace with AI advancements and emerging risks.

- Consult with insurance brokers and risk management experts for tailored coverage and strategic advice.

If you need personalized guidance or support, you can contact global risk management consultants or your insurance broker. For regulatory updates, refer to official sources such as the International Organization for Standardization (ISO) or your national data protection authority. Search for “ISO/IEC AI risk management” or “data privacy compliance” on their respective official websites for the most current standards and guidelines.

Key Takeaways and Next Steps

The integration of AI into business risk management offers significant advantages-proactive threat detection, predictive modeling, and improved efficiency-but also requires careful oversight and strategic planning. By assembling the right teams, investing in education, adopting proven AI technologies, and following established standards, companies can build resilience and protect their operations in an increasingly complex risk environment.

To learn more about optimizing risk management strategies with AI, consult with expert brokers, search for industry standards on official sites, and stay informed on the latest regulatory developments.

References

- [1] Workday Blog (2025). AI and Enterprise Risk Management: What to Know in 2025.

- [2] EY Global (2024). Why AI is both a risk and a way to manage risk.

- [3] KPMG International (2021). Artificial Intelligence in Risk Management.

- [4] IBM Insights. Risk Management in AI.

- [5] HUB International (2024). How AI is Changing Global Risk Management Needs for Companies.

MORE FROM ismath.net