How ESG Investing Transforms Corporate Governance: Opportunities, Challenges, and Practical Steps

Photo by Chris Turgeon on Unsplash

Introduction: Why ESG Investing Matters for Corporate Governance

Environmental, Social, and Governance (ESG) investing is profoundly changing how companies are governed. Investors and regulators are now prioritizing not just financial performance, but the broader impact companies have on society, the environment, and their own governance structures. This shift has prompted organizations to rethink board practices, transparency, ethics, and stakeholder engagement to remain competitive and credible in a rapidly evolving marketplace. [1] [2]

Understanding ESG Investing and Its Governance Pillar

ESG investing evaluates companies using criteria beyond traditional financial metrics. The governance component (“G” in ESG) focuses on how a company is directed and controlled, emphasizing board structure, executive compensation, reporting transparency, ethical conduct, and stakeholder accountability. [3]

Historically, governance was concerned mainly with shareholder rights and financial oversight. Today, ESG investing requires companies to consider a much wider group of stakeholders, including employees, suppliers, regulators, and the community. This more holistic approach redefines what “good governance” means. [1]

Key Impacts of ESG Investing on Corporate Governance

1. Enhanced Board Oversight and Structure

Boards are increasingly expected to integrate ESG considerations into their oversight functions. This includes forming dedicated ESG or sustainability committees, ensuring board diversity and independence, and embedding ESG risks into enterprise risk management (ERM) programs. [4]

For example, many companies now require board members with expertise in climate risk or social impact, reflecting the growing complexity of ESG issues. Practical steps to strengthen board oversight include:

- Evaluating current board composition for ESG knowledge and independence.

- Forming subcommittees focused on ESG oversight.

- Scheduling regular ESG strategy and risk reviews during board meetings.

2. Transparency and Reporting

ESG investing has driven demand for more rigorous and transparent reporting. Companies are expected to disclose their performance using recognized frameworks such as the Global Reporting Initiative (GRI) , Sustainability Accounting Standards Board (SASB) , and Task Force on Climate-related Financial Disclosures (TCFD) . [3]

These frameworks help companies:

- Benchmark ESG performance and identify risks.

- Communicate sustainability efforts to investors and other stakeholders.

- Meet regulatory requirements and gain a competitive edge.

For actionable guidance, companies should:

- Select a reporting framework aligned to their industry.

- Train internal teams on ESG data collection and analysis.

- Engage stakeholders in the reporting process for feedback and improvement.

3. Ethical Practices and Accountability

Good governance under ESG means fostering ethical behavior and accountability. ESG investing encourages companies to adopt robust codes of conduct, align executive compensation with long-term ESG goals, and hold management accountable for outcomes. [2]

Companies can implement these changes by:

- Reviewing and updating ethics policies regularly.

- Linking performance bonuses to specific ESG targets.

- Establishing clear whistleblower channels and reporting mechanisms.

Case studies show that organizations with strong ethical governance are better positioned to attract investment and avoid reputational risks.

4. Stakeholder Engagement and Investor Stewardship

Modern governance recognizes the importance of engaging all stakeholders. ESG investing has expanded the definition of “stakeholder” beyond shareholders to include employees, communities, regulators, and even competitors. [1]

Investor stewardship is now seen as a duty to encourage better governance in portfolio companies. Practical steps include:

- Regular stakeholder consultations on ESG issues.

- Inviting investor input on governance improvements.

- Publishing stakeholder feedback and company responses in annual reports.

Engaged stakeholders help identify risks and opportunities that may be missed by traditional governance approaches.

Regulatory Trends and Fiduciary Duty

Regulatory bodies worldwide are increasingly mandating ESG disclosures and integrating ESG into fiduciary duties for directors and fund managers. [5]

However, the relationship between ESG and fiduciary duty is still evolving. Some legal scholars and industry advocates debate whether prioritizing ESG could conflict with the duty to maximize shareholder value. Most recent legislative and regulatory changes, though, show a growing expectation that directors actively consider ESG factors as part of their fiduciary responsibilities. [5]

To ensure compliance:

- Stay up-to-date on ESG regulations and reporting requirements relevant to your sector.

- Consult legal counsel to clarify how ESG considerations fit within your fiduciary obligations.

- Develop internal policies for incorporating ESG into board and management decisions.

If you are unsure about regulatory requirements, you can visit your country’s securities regulator website or seek guidance from experienced ESG consultants.

Practical Steps for Implementing ESG in Corporate Governance

Integrating ESG into governance requires a strategic, stepwise approach:

- Conduct a Governance Audit: Assess current board practices, risk management, and reporting in relation to ESG standards.

- Set Clear ESG Objectives: Define short- and long-term ESG goals, assign responsibility, and align them with corporate strategy.

- Choose Reporting Frameworks: Select appropriate ESG reporting standards such as GRI, SASB, or TCFD, and ensure regular disclosures. [3]

- Engage Stakeholders: Consult with investors, employees, suppliers, and community groups to refine governance policies.

- Monitor and Adapt: Establish internal controls for continuous monitoring, and regularly review policies to reflect emerging ESG issues.

- Leverage External Expertise: If in-house expertise is limited, consider working with ESG advisory firms or using tools like ClarityAI for risk scoring. [4]

Challenges may include resistance to change, lack of expertise, or data collection difficulties. Solutions involve board education, engaging external consultants, and building robust internal reporting systems.

Alternative Approaches and Pathways

Not all companies are at the same stage of ESG integration. Alternatives include:

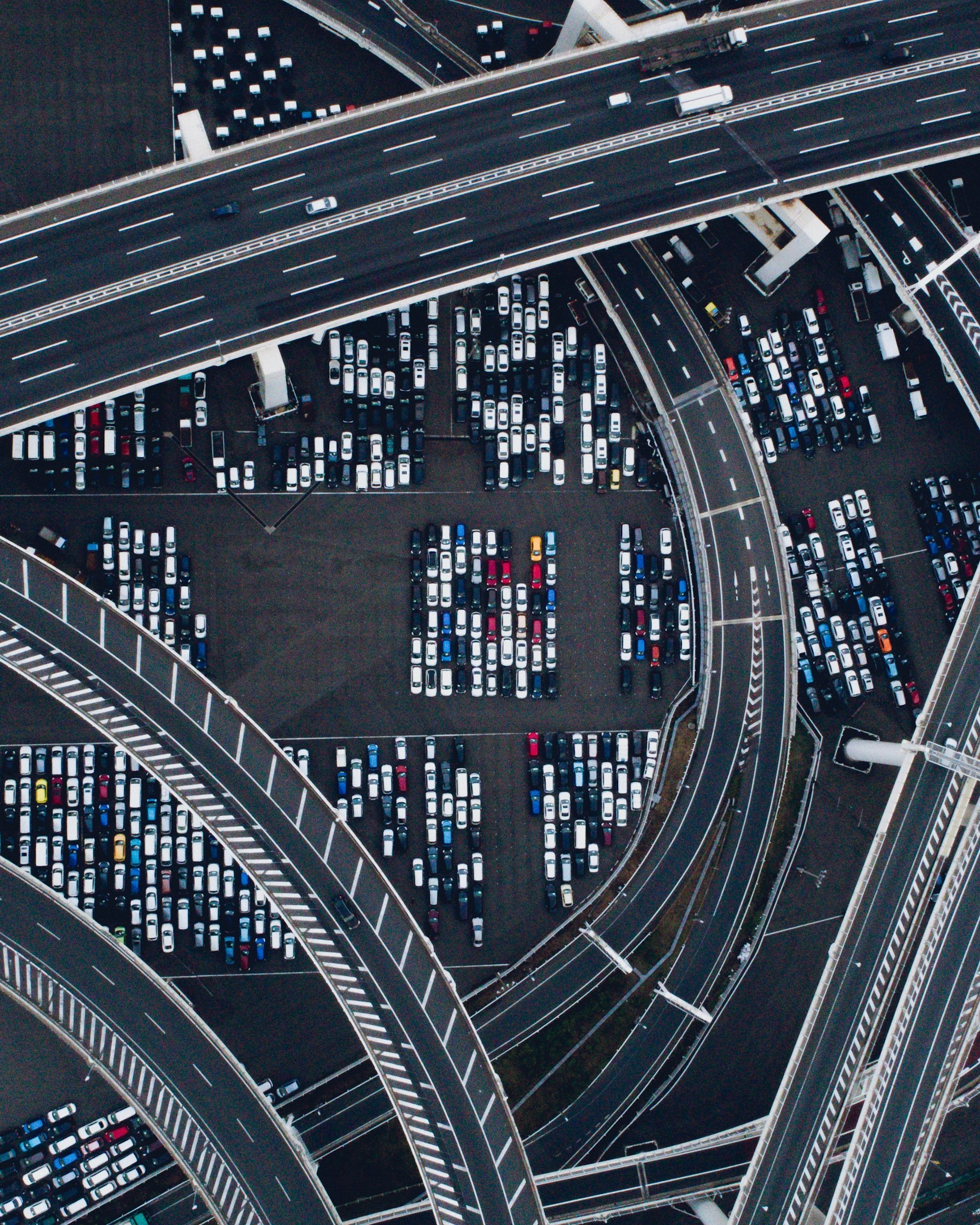

Photo by ZHENYU LUO on Unsplash

- Piloting ESG projects in specific departments before scaling company-wide.

- Joining industry groups focused on ESG best practices.

- Participating in sector-wide ESG benchmarking initiatives.

If resources are limited, start by prioritizing the most material ESG risks and opportunities for your business, then expand as capacity grows.

For those seeking guidance, you can find industry-specific ESG frameworks by searching for “[Your Industry] ESG standards” or consult organizations like the Global Reporting Initiative for sector guidance.

Key Takeaways: ESG Investing is Reshaping Governance

ESG investing is driving a transformation in corporate governance. Companies that embrace ESG principles are better positioned to manage risks, attract investment, and create lasting value for all stakeholders. By following practical steps and leveraging proven frameworks, organizations can turn ESG challenges into opportunities for sustainable growth.

References

- [1] Deutsche Wealth (2022). Corporate Governance: The “G” in ESG.

- [2] Corporate Finance Institute (2023). The Importance of ESG in Corporate Governance.

- [3] The Corporate Governance Institute (2023). ESG: A comprehensive guide to the main principles.

- [4] Diligent (2024). Environmental, social and governance (ESG).

- [5] Business Law Review – University of Chicago (2023). Environmental, Social, and Governance (ESG) and Fiduciary Duty.

MORE FROM ismath.net