Driving Toward Net Zero: Real-World Pathways to Carbon Neutrality in the Automotive Industry

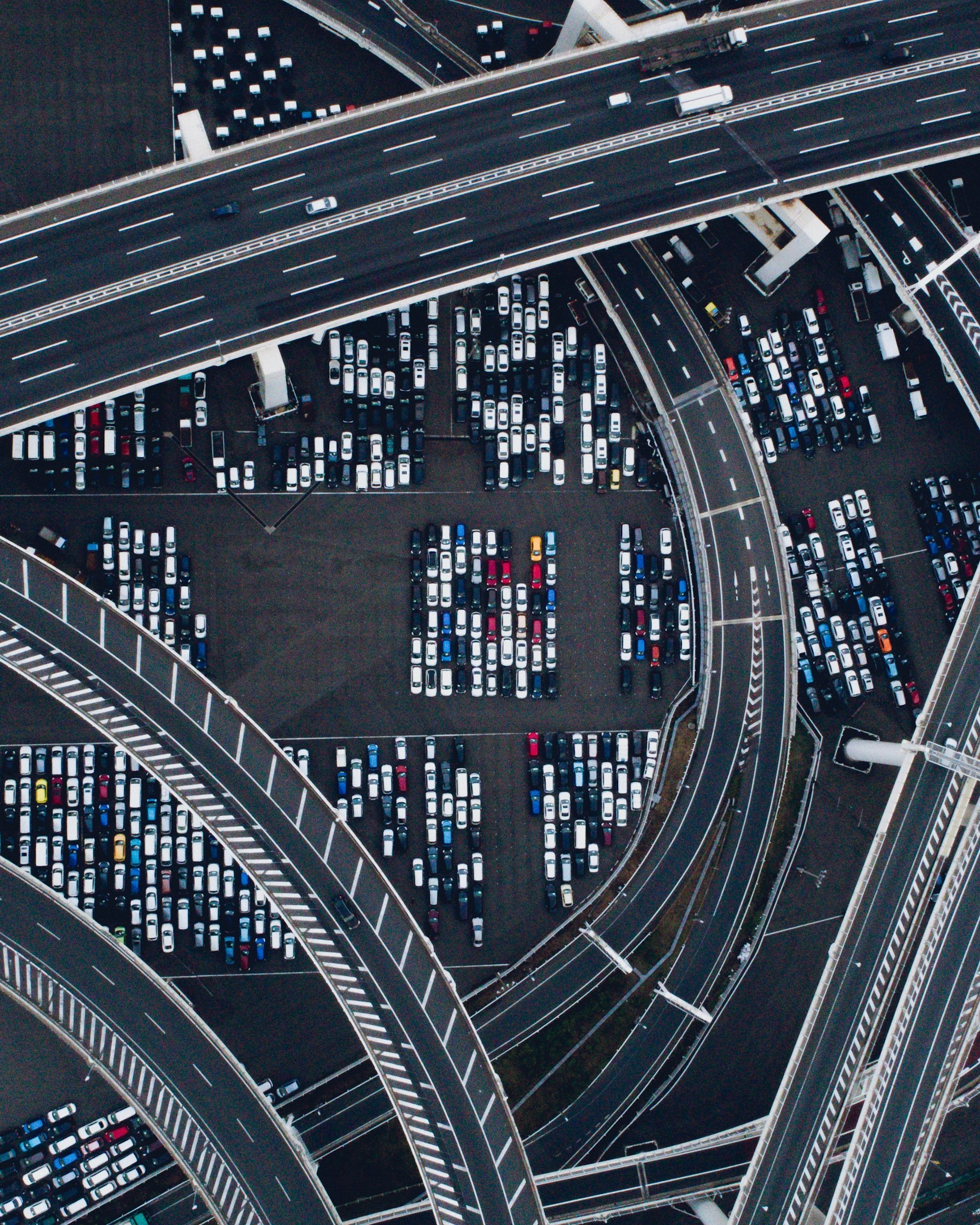

Photo by Vitali Adutskevich on Unsplash

Introduction: The Urgent Shift to Carbon Neutrality

The automotive industry stands at a crossroads, facing unprecedented pressure to decarbonize amid intensifying climate change concerns and evolving regulations. With road vehicles accounting for a substantial percentage of global greenhouse gas emissions-estimates range from 12% to over 20%, depending on the scope-sector leaders and policymakers are demanding credible, actionable pathways to carbon neutrality. The journey is complex, involving not only the production of vehicles but also the entire supply chain and lifecycle impacts of automotive products. [3] [2]

Industry Commitments and Targets: Where Do Major Automakers Stand?

Major automotive manufacturers have announced ambitious carbon neutrality goals-often targeting net zero emissions by 2050. For example, Toyota aims for carbon neutrality at all global manufacturing facilities by 2035 and across the value chain by 2050. [1] These goals typically include both direct operations and indirect impacts such as supply chain emissions, logistics, and the use phase of vehicles.

However, independent analyses reveal significant gaps between promises and measurable progress. [5] According to the 2025 Corporate Climate Responsibility Monitor, most automakers’ emission reduction targets remain critically insufficient for a 1.5°C pathway, with long-term pledges often lacking detailed implementation plans or transparency. [3] While Stellantis has made some progress, other leading brands such as Ford, General Motors, and Volkswagen have not significantly improved the ambition or credibility of their targets. [2]

From Pledges to Practice: Concrete Strategies for Emissions Reductions

To move beyond aspirational targets, automakers are investing in several key strategies:

- Electrification: Battery electric vehicles (BEVs) and hydrogen fuel cell vehicles are central to most decarbonization roadmaps. However, current BEV sales trends fall short of the targets needed for a 1.5°C-aligned transition. [3] Toyota, for instance, supplements BEVs with hybrids and plug-in hybrids to maximize emissions cuts with existing battery resources. [1]

- Green Manufacturing: Leading companies are integrating solar, wind, and other renewables into manufacturing, while updating equipment to improve energy efficiency. This shift is especially pronounced in Europe, where regulations and consumer demand are accelerating the adoption of green practices. [4]

- Supply Chain Decarbonization: Some automakers, like Ford and General Motors, have begun sourcing near-zero steel and aluminum, but many other critical supply chain transitions-such as reducing emissions from battery production-are lagging. [2]

- Circular Economy Initiatives: The use of recycled content in car manufacturing, particularly in batteries, is growing. Upcoming EU directives will require minimum recycled content and design-for-reuse strategies. [4]

Regulatory Drivers and Reporting Mandates

Regulations play a significant role in driving industry transformation. The EU’s 2025 target of 93.6g COâ‚‚ per kilometer for new cars is spurring rapid development of EVs and efficiency improvements, while similar standards in other regions are creating global momentum. [4]

Mandatory sustainability disclosures, such as those required under the EU’s Corporate Sustainability Reporting Directive (CSRD), are increasing transparency and accountability. From 2025, automakers operating in the EU will need to provide detailed sustainability performance data, compelling them to align operations with their climate pledges. [4]

Practical Steps for Businesses and Stakeholders

For organizations seeking to align with the evolving carbon neutrality landscape, the following steps may be helpful:

- Understand Regulatory Requirements: Stay informed about current and upcoming regulations in your operating regions. You can do this by following industry publications or visiting the official websites of agencies such as the U.S. Environmental Protection Agency or the European Commission. Search for “automotive emissions standards” or “corporate sustainability reporting requirements.”

- Engage with Suppliers: Request emissions data and transparency from your suppliers. Many organizations use supplier engagement platforms or sustainability assessments to collect this information.

- Invest in Electrification: Transitioning fleets or product lines to electric vehicles is a key action. Evaluate available incentives by consulting your local government’s energy or transportation office. Funding and rebate programs may be available through official energy agencies or utility providers.

- Implement Circular Practices: Prioritize recycled content and design-for-reuse in your procurement and product development. New EU directives are making these practices mandatory for certain vehicle components.

- Monitor and Report Progress: Adopt recognized sustainability reporting frameworks such as the Global Reporting Initiative (GRI) or align with the CSRD if operating in the EU. Use internal audits and third-party verifications to enhance credibility.

For those seeking more detailed guidance, industry associations like the International Council on Clean Transportation and business consultancies such as PwC and Deloitte offer reports and tools on automotive sustainability best practices.

Case Studies: Progress and Challenges

Toyota: Toyota’s science-based targets include a 68% reduction in greenhouse gas emissions from operations compared to 2019 by 2035, with broader goals for carbon neutrality by 2050. The company’s strategy includes hybrids, plug-ins, BEVs, and FCEVs, recognizing the need for a multi-technology approach while supply chains for batteries and renewable energy scale. [1]

Stellantis: As one of the few automakers with improved emission reduction ambition, Stellantis is working toward near-zero steel and aluminum procurement, with increasing investment in electric vehicles. [2]

European Automakers: According to Deloitte, European manufacturers have cut emissions from operations by 20% since 2021, even as production volumes have grown. Upcoming EU rules on recycled content and detailed sustainability disclosures are expected to drive further progress. [4]

Despite these advances, the majority of automakers have yet to set credible phase-out dates for internal combustion engines or provide detailed plans for achieving net zero. Many pledges lack transparency and rely on future technologies or offsetting, rather than concrete emission reductions. [3]

Common Challenges and Solutions

Challenge:

Insufficient Detail and Accountability

Many carbon neutrality pledges lack clear roadmaps and measurable milestones. To address this, companies should set interim targets and publish regular progress updates using standardized metrics.

Challenge:

Supply Chain Complexity

Decarbonizing the supply chain is difficult due to the global, fragmented nature of automotive manufacturing. Solutions include developing supplier codes of conduct, leveraging digital platforms for emissions tracking, and prioritizing partnerships with suppliers already investing in clean energy.

Challenge:

Technology and Infrastructure Limitations

The pace of EV adoption is constrained by battery production capacity, charging infrastructure, and affordability. Companies can work with industry consortia or public-private partnerships to accelerate deployment of charging networks and invest in next-generation battery technologies.

Alternative Approaches and Long-Term Outlook

Some automakers are pursuing alternative fuels, such as biofuels or synthetic fuels, for hard-to-electrify segments. Others are experimenting with carbon capture, utilization, and storage (CCUS) within manufacturing operations. While these approaches are promising, they remain in early stages and should be viewed as complementary to, not substitutes for, direct emission reductions and electrification.

For smaller businesses or suppliers, participating in voluntary industry initiatives (such as the Science Based Targets initiative) and leveraging available government incentives can provide a practical starting point for decarbonization. You may also consider working with third-party consultants or joining collaborative platforms focused on automotive sustainability.

How to Get Started: Step-by-Step Guidance

If you are seeking to align your business or organization with carbon neutrality goals in the automotive sector, consider the following steps:

Photo by Possessed Photography on Unsplash

- Identify your current emissions profile-including both direct and indirect sources-using established tools or consultancy support.

- Set clear, time-bound reduction targets that align with recognized standards (for example, through the Science Based Targets initiative).

- Engage with your supply chain to collect data and implement improvement programs.

- Transition to renewable energy, both onsite (solar, wind) and via power purchase agreements, where feasible.

- Integrate recycled materials and design-for-reuse practices into your product and procurement strategies.

- Monitor, report, and communicate your progress transparently using frameworks such as GRI or CDP.

If you require further support, you can contact industry associations, sustainability consultancies, or search for official resources from the U.S. Environmental Protection Agency, European Commission, or your national transport and environment departments.

References

- [1] Toyota (2025). Our Path to Carbon Neutrality.

- [2] NewClimate Institute (2025). Corporate Climate Responsibility Monitor – Automotive Sector.

- [3] Carbon Market Watch (2025). Automotive: 2025 Corporate Climate Responsibility Monitor.

- [4] Sustainability Magazine (2025). How Can the Automotive Industry Excel in Decarbonisation?

- [5] Carbon Market Watch (2025). Automotive manufacturers sector deep dive.

MORE FROM ismath.net